Founder’s Guide to Market Research

Doing pre-launch market research can take as little as two or three days and significantly improve your plan.

What to build for profit. Figure out what exactly people want, how they want to buy it, and how much money can you potentially earn.

Identify your first customers. Figure out the profile of your initial target audience. It helps you to choose the right location, to select promotion channels, and to write an effective one-line description of your offering.

Focus on the questions that are most critical to you. If you can get answers only to three questions about your market, what would you ask? Postpone less critical questions until after you’ve launched the company.

Action steps:

- Write down 3-5 key questions you want to know about your market.

- Get your answers.

- Identify 3-5 small-scale business opportunities that can lead to revenue in 1-2 months.

Market

Market volume. How many customers are there in your market category? How much time and money they are spending on similar products (or on solving similar problems)? What is the average selling price?

Market niches. What is the natural decomposition of your market into segments? By geography, by price, by features? What are the most attractive segments to enter? What are the most important groups of customers to think about?

Competition. There are three types of competitors: most similar solutions in your market, alternatives, and similar solutions in other countries. You should know key competitors of every type. Alternatives are most likely the only real competitive threat in the near term. Similar solutions in other countries are sources of inspiration and a cheap way to learn at their expense. In most cases, similar solutions in your market are a distraction. Do not match direct competitors feature by feature. Instead, focus on satisfying customer needs.

What market share do your competitors have? What can be a realistic market share for a new player like you?

Trends. Is your market growing or shrinking? Are there any big changes (regulation, technology breakthrough, adjacent markets) that affecting the market? Is there any significant change in customer behavior?

Customer profile

This is the place, where people tend to ask a lot of unnecessary questions like how many kids do customers have or what is their education level. Ask the most relevant questions only.

Ask yourself, how I will use the answers? If answers are not useful, do not ask these questions.

Demographics. What kinds of customers are there in your market? Can you write a few stereotypical portraits? What else do they buy? From whom? Where do they like to go, what are their other interests?

Early adopters. Who may buy from you first? Narrow down to a few small groups that have a high chance of being interested in your product. In the case of B2B products or services, can you make a list of the most promising potential buyers?

How they buy. In a family or an organization, who is making a purchase decision? Who pays? From what budget does the money come from? Are there any seasonal factors?

Sales channels. Who is influencing opinions in your market? Experts, publications, most vocal customers? What are the best channels to reach your target customers? Price. How many people are ready to pay for a solution? How do they think about price?

Remark. If you work on multi-sided products like a marketplace, do research on customer profiles for every side.

Needs

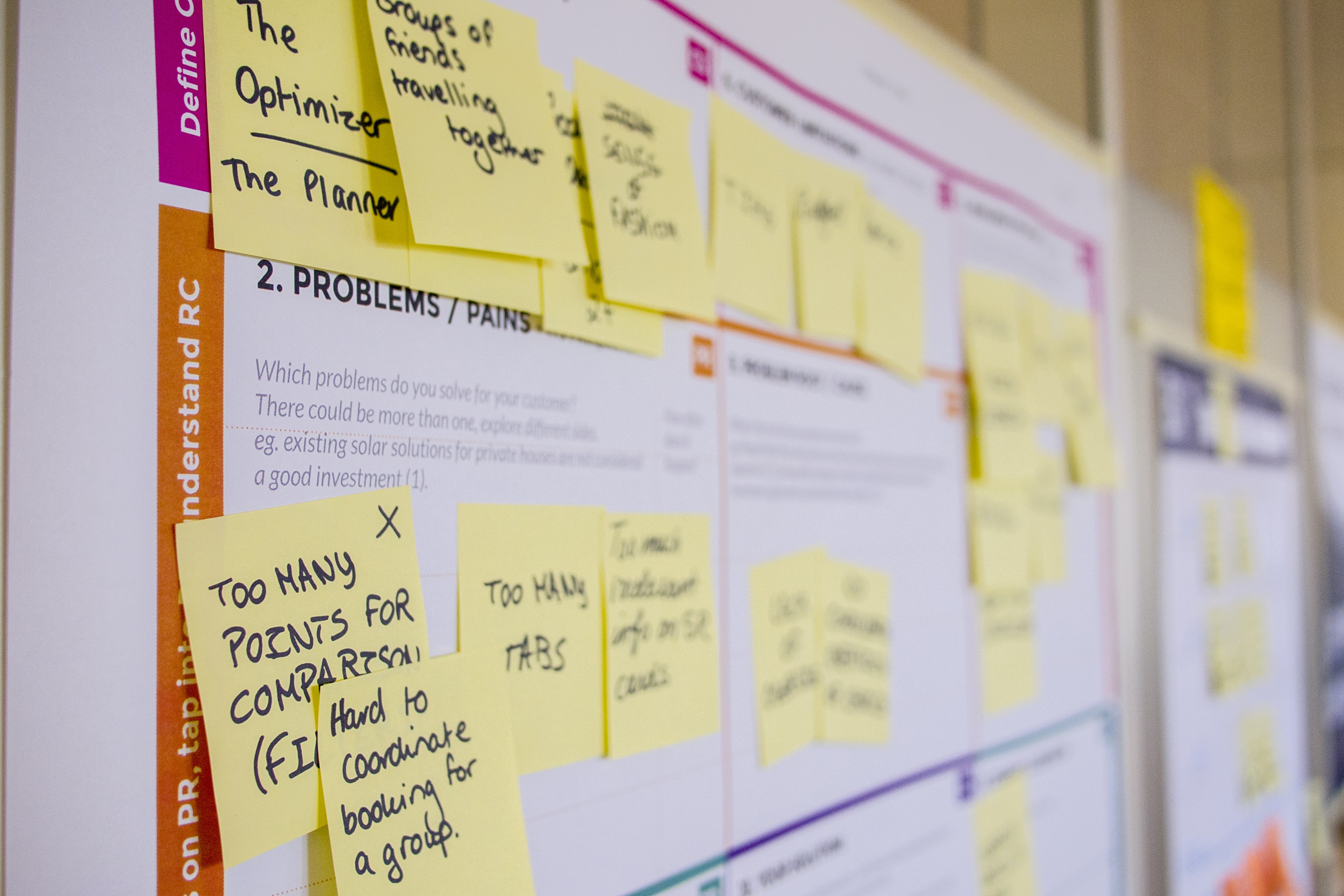

Problems. What problems do customers have? How strong is the pain? Can customers articulate these problems? What is the current solution?

Complaints. What are the current solutions? Do they solve the problem well? Is there any hate or frustration? Time or money lost? What is missing? Do people use any ugly band-aid hacks to solve the problem?

Benefits. Why do people buy solutions in your market? How does solving a problem change a customer’s life? What are the emotional benefits? How it affects customer’s social status?

Features. What factors do people consider when purchasing this product or service? Length, color, size, quality, efficiency, etc. Which features are more important, which ones are less important?

Solution

Interest. Describe your solution and ask whether they will buy it. Is it a ‘vitamin’ (nice to have) or a ‘pain killer’ (got to have it)? How much would they pay for it? What can justify the higher price? What is the minimum solution that people are ready to pay for?

Clarity. Does your one-line description works? Do people understand your value proposition clearly? Can they reformulate your offering in their own words?

How to conduct market research

Formulate questions in a form that can lead to disqualifying your assumptions. Instead of asking “Do you have problem X?”, ask “How often do you have problem X?” or “How much time and money do you spend to solve problem X?”. Instead of asking “who can be interested in solution?” ask “who will be the first to buy?”

Primary research

In the primary research, you get direct original input from the market. It is best suited for needs and solutions questions.

- Meet and talk to potential clients. Go in person to places and events, where your customers are concentrated. Find early adopters and enthusiasts who are interested in early access to the next generation of products.

If your target audience is skaters, go to the skate park.

- Find people who were selling similar products/services before. Talk to distributors, journalists, marketers, investors, other entrepreneurs in your field. Identify influencers, who were most actively promoting the previous generation of products in your field. Go to industry conferences or relevant meetups in your city.

- Pretend to be a customer. Buy/use a product from competitors.

Extreme: work at competitors. E.g. Russian entrepreneur Fedor Ovchinnikov went to work at McDonald’s before starting his own pizza chain.

- Do a survey. Use Google forms, Google Surveys, Survey Monkey, PollDaddy, or polling feature in social networks. Consider using just 1-5 questions for your first survey.

- Ask questions on social networks like Quora, Twitter, and Facebook. Promote your questions through related online communities, forums, and mailing lists.

Rewards. Have something valuable for people who answer your questions. E.g. priority access, a discount towards your future product. Interview people in Starbucks and give them Starbucks gift cards for their time. To motivate experts you may promise them to publish their answers in form of an interview in some respected publication or collective blog.

One-question surveys. You can get more insightful comments and stories for one well-articulated question than from an elaborate survey.

Tell a story. A great emotional story about a deep problem, unsatisfactory current solutions, and your mission to fix it is really helpful. Put your questions in the end. Have comments. Publicize the story on social networks and industry blogs. Give a talk. Be controversial and conversational. You will learn a lot.

Secondary research

Learn from publicly available information. Secondary research is most useful for market and customer profile questions.

- Competitors. Pay special attention to alternative solutions and analogs in other countries. Google your “benefits keywords”. What solutions are showing up? Estimate economic parameters of your competitors: number of customers, average check, number of employees, revenue, profitability. What metrics do they report? Are there any interviews with competitor leaders?

- Product reviews. What do people complain about? Do a similar search over social networks, look for phrases like “I hate X because…” or “I wish X would have this additional feature.”

- Search statistics. How much do people search for solutions in your market? What words do they use? Is search volume growing or decreasing? Who is advertising on these keywords? Use Google AdWords Keywords tools and Google Trends Explore.

- Market numbers. Google any number you need like “number of students in Romania”, “number of restaurants in San Francisco”, or “average investment to open a restaurant”. Find numbers from several sources.

Beware of generic information like data from government or trade associations. These numbers do not confirm the specific needs or sizes of your initial market niche. You can easily fool yourself into having a larger market than exists in reality.

Use Google Trends to compare relative interest in different products and value propositions

Act on your research

Changes your idea. Does your market research confirm the problems exist? How strong is the pain? How bad are current solutions? Are people ready to pay for a better offering? Is there a real opportunity, after all? Consider looking for other ideas, if problem confirmation is weak.

Change product. Have you learned something new? Can you simplify the product based on feedback? What is an absolute must-have for the first version? What can be postponed for future updates?

Start relationships with your early adopters. Have you identified, who is likely to become your initial customers and cheerleaders? Try to involve them in product creation. Give them early access before the official launch. Keep them updated through social networks, a blog, or an e-mailing list.

Written by Yury Lifshits